Celsius Holdings, Inc. (CELH) has seen significant growth in the energy drink market over recent years, drawing considerable attention. However, the recent decline in Celsius stock, with a 3-month return of -57% and a 1-month return of -13%, has raised concerns about the company’s growth prospects.

This post will provide a comprehensive analysis of Celsius stock valuation, energy drink market trends, institutional investor activity, and CELH ratings to assess the current state and future outlook for Celsius stock.

Celsius Stock Valuation

CELH Price Return: As of August 21, 2024, Celsius stock is trading at approximately $40~41, with the 50-day moving average at $51.05 and the 200-day moving average at $68.63.

CELH Valuation: The company’s market capitalization stands at around $9.40 billion, with a price-to-earnings (P/E) ratio of 39.63, and a beta of 1.35, indicating that Celsius stock is sensitive to market volatility. When compared to its peer group, such as STBFY with a P/E ratio of 19.43 and FIZZ with a P/E ratio of 24.18, CELH’s stock valuation is relatively high.

CELH EPS: The latest quarterly earnings report(Q2 2024) showed an earnings per share (EPS) of $0.28, surpassing the expected $0.23. Revenue for the quarter reached $402 million, marking a 23.4% year-over-year increase, exceeding market expectations.

U.S. Energy Drink Market Trends

According to Nielsen, U.S. energy drink sales decreased by 1.1% year-over-year for the four weeks ending August 10, 2024.

During this period, Celsius stock outperformed its competitors with an 8.8% increase in sales, though this was a slowdown from the previous period’s 12.3% growth. Celsius achieved a 16.6% increase in volume, but prices dropped by 7.8%. As a result, Celsius secured a 9.6% share of the U.S. energy drink market.

Competitors like Bang Energy and Red Bull saw sales increases of 6% and 1.8%, respectively, while Monster Beverage experienced a 3.5% decline.

These trends indicate that despite the overall market slowdown, Celsius stock is performing relatively well compared to its peers.

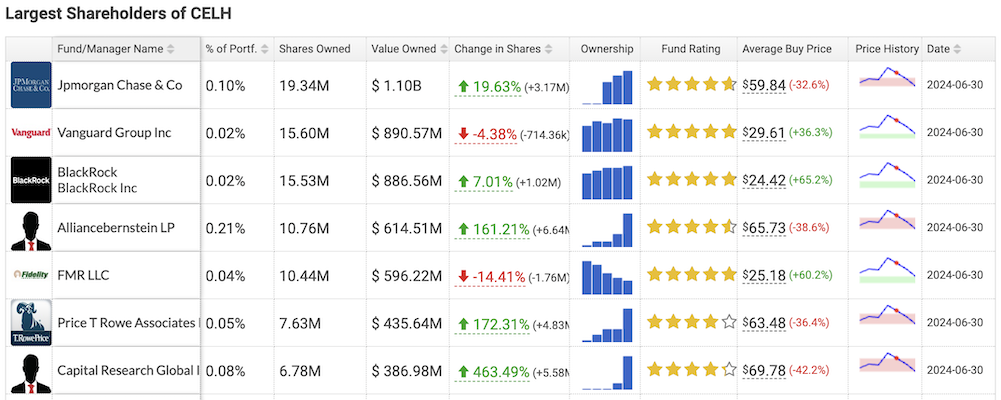

Institutional Investors Activity of CELH

Several major institutional investors have either maintained or increased their holdings in Celsius stock. Overall, institutional investors remain largely optimistic about the long-term potential of Celsius stock, despite recent market challenges.

Notably, Alliancebernstein LP, Price T Rowe Associates Inc., and Capital Research Global Investors significantly increased their positions by 161%, 172%, and 463% respectively during Q2 2024, reflecting strong confidence in Celsius stock. On the other hand, Vanguard Group Inc. and FMR LLC reduced their holdings by 4.38% and 14.41%, respectively.

Celsius Stock Ratings & Target Price

Analysts have assigned Celsius stock a “Moderate Buy” rating, with an average price target of $67, implying a potential upside of approximately 63%. Recent price target revisions have ranged from $6 to $30 lower, but the majority of analysts still maintain a Strong Buy or Buy rating on Celsius stock.

- Morgan Stanley maintained an “Equal-weight” rating with a $50 price target, noting that Celsius may take longer than expected to achieve mid-tier market share. (Aug 20)

- Truist Securities maintained a “Hold” rating but lowered the price target from $60 to $45. (Aug 9)

- Bank of America downgraded Celsius to “Underperform,” reducing the price target from $60 to $32. (Aug 8)

- Piper Sandler maintained a “Buy” rating but lowered the price target from $90 to $65. (Aug 7)

Celsius Stock Analysis Summary

A balanced approach, weighing short-term uncertainties against long-term growth prospects, is advisable when considering an investment in Celsius stock.

Bullish Approach

Celsius stock has attracted significant interest from major institutional investors, driven by its consistent revenue growth and strong profitability. The company’s market share continues to rise, with sales growing faster than its competitors. These positive results underscore Celsius’s long-term growth potential. With the current stock price at $41 and an average price target of $67, the potential upside is approximately 63%, making it an attractive investment.

Bearish Approach

The recent decline in Celsius stock has raised concerns among investors, particularly following downward price target revisions by almost analysts. The overall slowdown in the energy drink category and intense competition could pose risks to Celsius’s growth. Additionally, the stock’s relatively high P/E ratio and elevated beta suggest a sensitivity to market volatility. The most conservative price target is set by B of A Securities at $32, which indicates a potential downside of -21% from the current price.

* References: Google News, ETF Daily News, Smarter Analyst, stockanalysis.com, hedgefollow.com, Celsius

** Warnings: This blog content is not a solicitation or recommendation to buy or sell any securities. The information contained herein is not intended as financial advice and should not be construed as such. All investment decisions are the sole responsibility of the investor.