First Solar Stock(FSLR) has recently experienced a slight drop, with prices falling by 4% to around $220. This decline is closely linked to the increasing concerns among major investors and a bearish outlook in recent options trades. The recent First Solar Stock Drop is more than just market volatility; it’s a direct response to escalating economic pressures, particularly the sharp increase in imported solar panels from Vietnam and Thailand. In this blog, we’ll explore the key factors behind the recent decline in First Solar’s stock price, focusing on how rising imports and the potential imposition of tariffs could shape the future of the solar industry.

Bearish Option Trades by Big Investors

According to Benzinga, there have been 17 unusual options trades involving First Solar, with 52% of these trades predicting a decline in the stock price, while only 35% expect a rise. Specifically, about $309,278 worth of put options (betting on a price drop) were traded, compared to $444,281 worth of call options (betting on a price increase). These bearish bets by big investors could significantly impact First Solar’s stock price.

- $170 Put Option: total trade value of $164,400, volume of 255(Expiring on Jan 17, 2025)

- $250 Call Option: total trade value of $50,000, volume of 220(Expiring on Sep 20, 2024)

- $240 Call Option: total trade value of $48,000, volume of 23(Expiring on Jan 17, 2025)

FSLR Stock Target Price

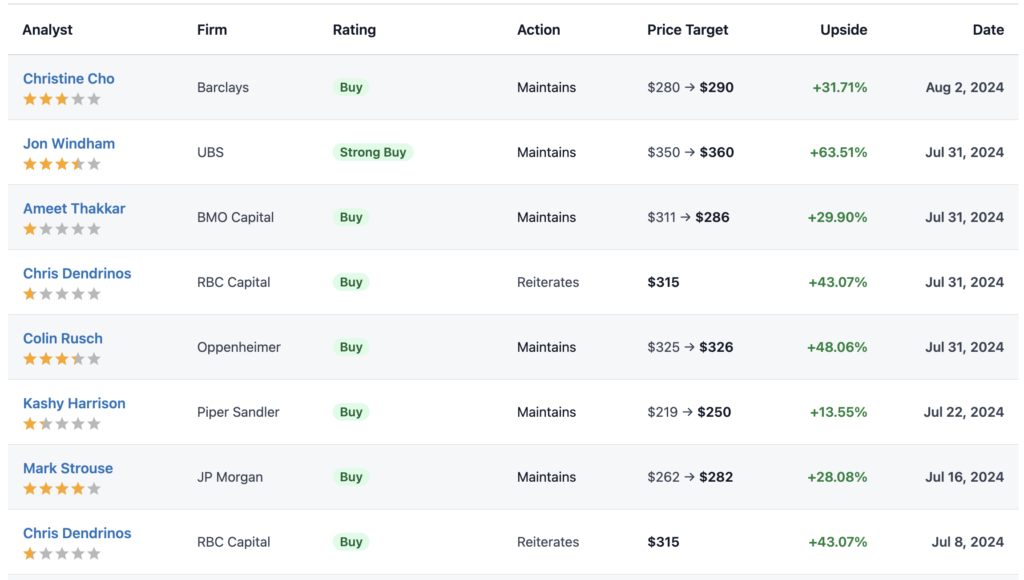

Over the past 30 days, five analysts have set an average target price for First Solar at $308.2. While some maintain a positive outlook, the current market conditions and the bearish approach by large investors suggest that volatility is likely ahead for First Solar’s stock.

Impact of Rising Solar Panel Imports on FSLR Stock

The Surge in Imported Solar Panels

The U.S. solar panel market has been heavily impacted by a surge in low-cost imports from Vietnam and Thailand. During the Q2 2024, solar panel imports from Vietnam increased by 39% from the previous quarter, while imports from Thailand rose by 17%. This influx has eroded the market share of domestic manufacturers, including First Solar, which is now seeking ways to counteract this trend.

In response, U.S. solar module manufacturers, including First Solar, have called for retroactive tariffs, citing “critical circumstances.” They argue that the surge in imports is a result of Chinese-based companies accelerating exports from Vietnam and Thailand to avoid impending anti-dumping and countervailing duties (AD/CVD).

The Call for Solar Panel Tariffs

The proposed retroactive tariffs aim to promote fair competition in the market and protect the domestic industry. The manufacturers are requesting that all solar panels imported since April 2024 be subject to a 25% tariff or higher. If these tariffs are implemented, the price of solar panels in the U.S. could rise to three times the international price.

While these tariffs could boost domestic production and create jobs, they also risk increasing consumer prices and installation costs, potentially delaying or reducing the adoption of solar energy.

Impact on First Solar Stock

The call for retroactive tariffs underscores the challenging market conditions faced by U.S. solar manufacturers, which could negatively impact First Solar’s stock. The increased competition from imports, particularly from Vietnam and Thailand, has been a major factor in the recent decline in First Solar’s stock price.

In the first half of 2024 alone, Vietnam and Thailand shipped 2.6GW of solar modules to the U.S., with Vietnam’s exports growing 45% year-over-year, totaling $3.3 billion. This surge in foreign products has led to decreased market share for companies like First Solar, prompting them to seek tariffs as a defensive measure.

The Future of Solar Panel Tariffs

The U.S. solar industry is at a critical juncture. “Solar panel tariffs” could serve as an essential tool to protect the domestic industry and foster fair competition, but the potential downsides cannot be ignored. If implemented, American consumers may face higher costs, potentially slowing the growth of solar energy adoption.

First Solar and other U.S. manufacturers are pushing for these tariffs to regain their competitive edge in the market, but they must also consider the broader implications, including delays in AI-driven power grid development. The outcome of these tariff decisions will have a significant impact on the future of the U.S. solar industry and First Solar’s stock price.

* References: Google News, Reuters, Benzinga, Stockanalysis

** Warnings: This blog content is not a solicitation or recommendation to buy or sell any securities. The information contained herein is not intended as financial advice and should not be construed as such. All investment decisions are the sole responsibility of the investor.