Investors are keeping a close eye on Palo Alto Networks(NASDAQ: PANW) as the cybersecurity giant continues to outperform market expectations. With the company recently announcing strong Q4 2024 earnings and an optimistic outlook for FY 2025, it’s no wonder the stock has been on the rise. But what exactly is driving this upward momentum, and what can we expect from PANW stock in the near future?

In this post, we’ll break down the key factors behind Palo Alto Networks(PANW)’ recent performance, delve into the company’s strategic moves, and analyze what analysts are saying about the stock’s potential. Whether you’re a seasoned investor or new to the tech stock scene, understanding these insights will help you make informed decisions about PANW. Let’s dive into the details and see why this cybersecurity leader is capturing so much attention.

Key Highlights from PANW Earnings and Guidance

PANW Q4 2024 Earnings Analysis

Performance in Q4 2024

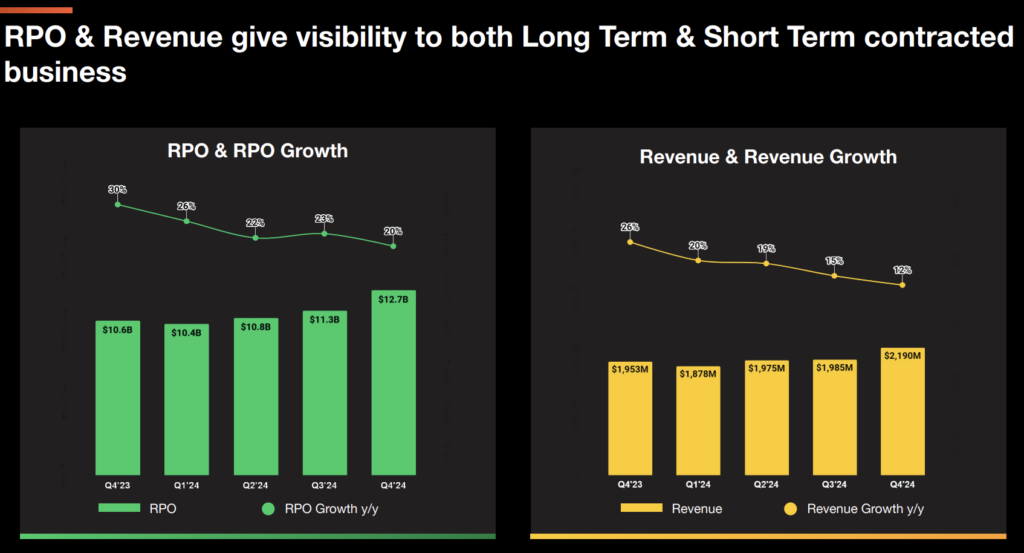

- Revenue: Palo Alto Networks reported $2.2 billion, surpassing analysts’ estimates of $2.18 billion.

- Net Income: Net income reached $358 million, marking a 57.1% year-over-year increase.

- EPS (Earnings Per Share): Adjusted EPS came in at $1.01, beating the forecasted $0.91.

- Security Revenue Growth: The company’s core security segment showed solid growth, significantly boosting overall performance.

Strategic Moves in Q4 2024

- Platformization Success: Palo Alto Networks’ shift towards a platform-based approach is paying off faster than expected, integrating multiple products and services into a cohesive offering.

- Cybersecurity Collaborations: The company expanded its collaboration with SLB (formerly Schlumberger) to enhance cybersecurity in the energy sector, a partnership expected to drive further growth in response to rising security demands in this industry.

PANW FY 2025 Guidance Analysis

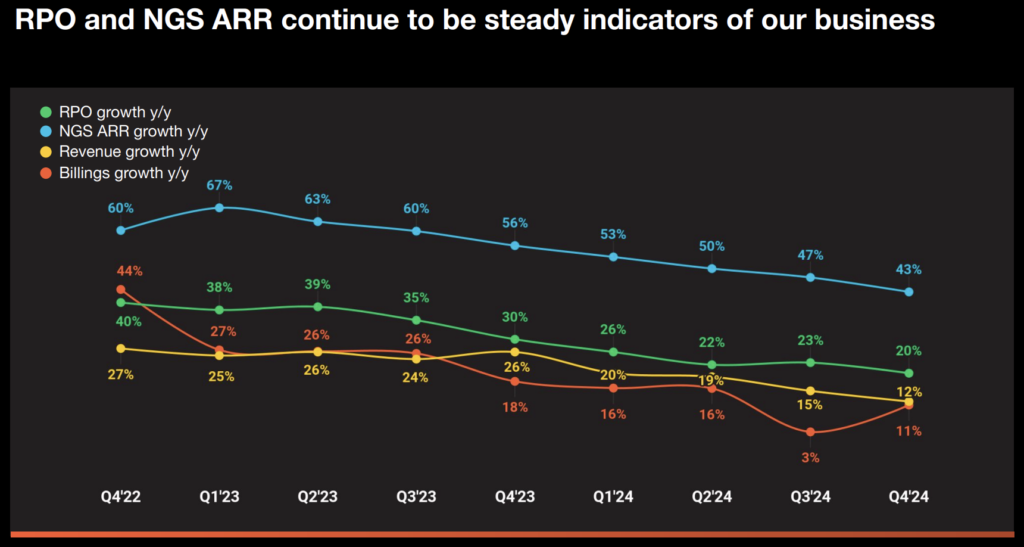

Palo Alto Networks raised its projections for revenue and EPS, signaling a positive outlook for the fiscal year. These revisions are likely to boost investor confidence, potentially lifting the stock price. However, there are concerns about the slower growth rate in billings.

FY 2025 Outlook

- Revenue Growth Forecast: The company now anticipates 12% to 14% revenue growth in FY 2025, up from the 10% to 12% previously forecasted during the Q3 2024 earnings announcement. This adjustment reflects strategic shifts and continued strong demand in the security market.

- Adjusted EPS: The adjusted EPS for FY 2025 is expected to be between $4.95 and $5.05, up from the prior guidance of $4.80 to $4.90 provided in the Q3 2024 earnings report, indicating a stable earnings growth trajectory.

- Share Buyback Program: The announcement of an additional $500 million share repurchase program underscores the company’s commitment to returning value to shareholders.

- Billings Growth Concerns: Despite a positive outlook, the slower-than-expected billings growth rate could weigh on the stock and warrants close monitoring.

Strategic Focus for FY 2025

- Rising Demand in Cybersecurity: The company expects continued strong demand in the cybersecurity market, which will be a key driver of its growth strategy.

- AI and Platform Integration: Palo Alto Networks plans to further enhance its competitive edge through AI-powered security solutions and deeper platform integration.

Market Reaction to PANW Earnings Announcement

Palo Alto Networks received a positive market response, driven by strong earnings and strategic execution. However, some analysts remain cautiously optimistic about the sustainability of this growth, advising investors to closely monitor the company’s platform strategy and cybersecurity expansions.

Positive Reactions

- Impressive Earnings: Palo Alto Networks outperformed analysts’ estimates, drawing positive reactions from investors.

- Strategic Outlook: Initial skepticism around the platform strategy has shifted to optimism, as it now contributes significantly to revenue growth. Several analysts have raised their target prices, reflecting increased confidence in the company’s future performance.

- Expanded Partnerships: The extension of cybersecurity partnerships, especially in the energy sector, positions Palo Alto for further revenue gains.

Negative Reactions

- Mixed Sentiments: Despite strong earnings, some analysts expressed concerns about the long-term sustainability of this growth, leading to a more cautious outlook.

- Market Volatility: The recent spike in stock price may trigger short-term volatility as investors adjust their positions, potentially leading to profit-taking.

PANW Stock Analyst Ratings & Forecast

Palo Alto Networks is currently viewed favorably by the market, with many seeing it as a stock with significant upside potential. This optimism is rooted in the company’s consistent growth, robust earnings, and the positive outlook for the cybersecurity industry.

Upgraded Price Targets

- Several leading analysts and investment firms have raised their price targets for PANW, reflecting the company’s strong financial performance and solid position in the cybersecurity market.

- Recent target prices range between $385 and $416, indicating a potential upside of 5% to 13% from the current price of $368.

- Bullish Evaluation: Among the most bullish, Andrew Nowinski from Wells Fargo increased his target from $385 to $416, reflecting a potential 14% increase.

- Bearish Evaluation: Conversely, analysts like Catharine Trebnick from Rosenblatt and Rob Owens from Piper Sandler maintained a more conservative stance, raising targets to $330 from $300.

Analyst Recommendations

- Many analysts are maintaining or upgrading their ratings to “Buy” or “Overweight” for PANW, indicating strong confidence in the company’s growth prospects.

- This positive sentiment reflects a high level of trust in Palo Alto’s ability to continue its upward trajectory.

Market Outlook and Competitive Advantage

- The company’s track record of exceeding earnings expectations has bolstered trust among investors and analysts.

- Revenue growth, particularly from cloud security and AI-driven solutions, continues to be a significant driver.

- As global emphasis on cybersecurity increases, the market continues to expand. PANW maintains its competitive edge through innovative technology and a diverse product portfolio.

- This favorable market environment, combined with the company’s strategic initiatives, is expected to support further stock price appreciation.

* References: Google News, investors.paloaltonetworks.com

** Warnings: This blog content is not a solicitation or recommendation to buy or sell any securities. The information contained herein is not intended as financial advice and should not be construed as such. All investment decisions are the sole responsibility of the investor.